QRHC Part 2: Mispriced Disruption

Change happens two ways: slowly, then all at once. Quest's revenues are accelerating in a way the market has yet to appreciate.

Welcome to Efficiencies, a blog situated at the intersection of strategy and sustainability, exploring all that relates to the business models and industry dynamics of the disruptors and the disruptees in our shift to the Green Economy.

Welcome to the new subscribers and special thanks to the reader who provided me with transcripts of interviews with Quest’s customers.

Welcome to Part 2 of the dive on QRHC, a waste management brokerage company. Part 1 covered the waste management industry backdrop and how Quest’s disposal agnostic business model and analytics services positions them to capitalize on fragmenting waste streams and customer demand for waste diversion. Part 2 takes a closer look at Quest the business and the latter part of the thesis put forward in part 1:

This company is a unique case study in preparation meeting opportunity. Its brokerage business model is better aligned with its customers interest and is disposal agnostic at a time when (1) large corporations are becoming more thoughtful about waste and disposal and (2) disposal and recycling are becoming more specialized. It is also coming into this opportunity from a turnaround that masked accelerating organic growth and (necessarily) de-levered operating expenses. With the turnaround and COVID now behind Quest, this $77m market cap company is signing seven figure contracts with Fortune 1000 businesses, expanding with existing customers and re-leveraging its operating expenses. For the numerically inclined, this means double digit top-line growth, >600 bps margin expansion and a triple digit CAGR in operating income and earnings for the modest cost of 13x FY21 earnings.

Note: I have a position in QRHC. The following is a mostly comprehensive summary of my research, not investment advice. Do your own.

Second note: I tweaked the numbers in my model since publishing part 1, and as of posting the numbers here are most timely. I regularly play around with my numbers and don’t plan to keep updating them here unless there is a material change in my thesis.

Company Background

The spirit of Quest began with a company called Oakleaf Global Holdings, one of the largest waste hauling brokers with $580m in sales at the time of its acquisition by Waste Management for $425m in July 2011. Waste Management CEO David Steiner estimated the deal would add at least $80m in EBITDA by redirecting Oakleaf’s collection vendors to their landfills (emulating the profit maximizing strategy for vertically integrated waste companies outlined in part 1).

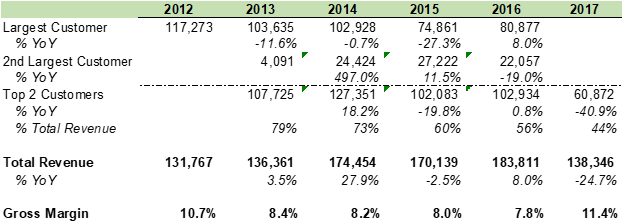

Quest’s actual business began as a single state trial service with Walmart in 2007 and grew through expanding business with a few massive customers, generating 76% of its revenues from its largest customer in FY13. The early Quest had a distinctly environmental bent that drove it to expand its services beyond waste hauling and commodified recycling programs into innovative offerings like its food waste recovery program, which management estimated in 2015 was the largest in the industry. However, much of their early business was simple non-value-added services tied to motor and cooking oil recycling which left Quest competing purely on price and exposed to commodity swings. These contracts were low margin and, after oil prices crashed in 2015, unprofitable.

In 2016, two former Oakleaf executives, CEO Ray Hatch and COO Dave Sweitzer, joined Quest and accelerated the company’s transition towards customers with complex waste streams, where Quest’s comprehensive programs and value-added services (including data reporting) provided a valuable point of differentiation. They wound down business with low margin legacy customers and restructured remaining contracts to protect against commodity risk. Ray laid out the opportunity in the Q4 earnings call, which is worth quoting in full:

“I'd like to share with everybody why we're so excited about the future here at Quest. Quest has tremendous efficiencies of scale and scope. We're the only vendor with a national footprint and a service offering that includes almost all waste streams. This provides a significant competitive differentiation.

We have a strong brand with a reputation of solving customer problems, allowing them to focus on their core business, helping them achieve their overall goals. We provide a great value proposition to our customers, and to our subcontractors. For customers, Quest provides a single point of contact with one throat to choke, if you will. We are flexible, solution-driven partner and provide consistent reporting and actionable data.

For our subcontractors, Quest adds business, and by increasing raw density and asset utilization for them, we help them improve their profitability as well. We have an asset light business model that provides us flexibility to meet our customers' needs; opportunities to leverage our footprint and core competences in our new vertical markets and expand the size of our addressable market. Finally, there are significant and disruptive changes in how companies look at handling their waste, instead of sending waste to a landfill, companies are looking for ways to economically recycle. Quest is well-positioned to benefit and in some cases take a leadership role effecting these changes.”1

Management articulated four key initiatives for their multi-year turnaround:

Expand into new market verticals. Old Quest was focused in retail and automotive. Management identified the industrial vertical, with its sensitivity to downtime and tight regulations, as an attractive target and leveraged its food waste programs to expand into restaurants.

Reorganize sales organization. Incentives, incentives, incentives. Sales compensation was realigned with profitability as opposed to pure sales. Veteran salespeople with 15-20 years of experience and relationships with target verticals were brought on board. It’s important to note that the waste management business is a relationship based one; the RFP process and implementation is high touch and customers’ purchasing teams want to like who they’re working with. In fact, the Buffalo Wild Wings contract, which generates $5-6m in revenue, came about because the purchasing manager had worked with Oakleaf ten years prior and proactively reached out to Quest.

Improve procurement. Quest bulked up its procurement team and expanded its vendor relations. This translated into better pricing and improved gross margin.

Invest in technology and process efficiency. COO Dave Sweitzer streamlined workflows and invested in IT infrastructure focused on automating internal processing, management, data collection and reporting.

From 2016 to the end of 2019, Quest’s revenues shrunk 45% while gross profit dollars grew by 30% and adjusted EBITDA margin expanded 440 bps.

Typically, companies that complete a sound restructuring see a corresponding appreciation in their value. Unfortunately for Quest, a series of unfortunate events obscured the signal that the restructuring was complete – a return to revenue growth – and kept the stock from re-rating.

In Q4 of 2019, Quest’s CEO declared that the company had lapped the last of its strategically exited contracts and, armed with its beefed-up sales team, was ready to reignite top line growth. New wins had in fact ticked up in 2019, but were offset by a large, low margin industrial customer experiencing a downturn. 2020 would be the first clean year where Quest would go on the offensive: new and expanded business combined with lapping the industrial slowdown would generate solid comps. Pipeline conversion would improve as the sales team capitalized on inroads in new verticals, refined their go-to-market and targets became more familiar with the value of Quest’s brokerage model. Management remained steadfast in their expectation for 10-15% post-restructuring revenue growth. Then COVID happened. Although most of Quest’s customers were deemed essential, revenues are tied to volume and the downturn in end markets was enough to offset expansions with existing customers and new business won in earlier quarters. Targets paused or delayed RFPs for the first half of the year, pushing out pipeline conversion.

This set up an incredible investment opportunity to own a highly scalable, differentiated business, led by an experienced management team, that has successfully completed restructuring but whose value has hereto been obscured by circumstances beyond management’s control. All told, the pandemic set Quest back a few quarters. The company continued to execute, announcing new wins and acquiring Green Remedies, a regional multi-family waste solutions provider, in Q3 2020. The following quarter revenue inflected with 9% organic growth. In Q1 2021, organic growth accelerated to 26% and Quest generated $3.8m in free cash flow, +50% more than the $2.4m it produced in the prior fiscal year.

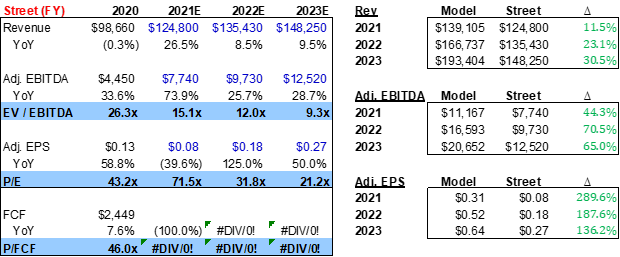

Quest’s stock has responded with 152% year-to-date (YTD) appreciation and now trades at 15x consensus EV/EBITDA. Despite this impressive run, the market is still wildly underestimating the growth opportunity for Quest. This is partly attributable to Quest’s size: small companies don’t receive a lot of attention and are generally more prone to being under-researched and misunderstood. But management is reticent to give firm guidance and overly conservative on the guidance they do give. My own estimates are significantly higher than consensus, driven by higher sales and margin expectations. If I’m correct, this is easily a $10 dollar stock by next year.

Quest has a pathway to a ~25% 3-year revenue CAGR, stemming from a combination of expansion with existing customers, new business wins and COVID end market recovery.

New Business Wins & Customer Expansions

Quest’s long sales cycle gives a high degree of visibility on revenues. Sales are done through a high-touch RFP process that management says averages 6 months, though larger customers or more complex projects appear to take 12 months. After winning a contract there’s a 3-month transition period until a contract is fully revenue generating; more complex projects can take longer to ramp up. This gives high visibility into the next few quarters, and management usually calls out major seven-figure wins by vertical.

At minimum, a 7-figure win is $1m in annual revenue; a “smaller win” is around $500k. I put together a walk for quarterly revenue using bear and base assumptions for win sizes and incorporating the Green Remedies acquisition:

I would rather be approximately correct than precisely wrong, so my point here isn’t to argue the exactness of my assumptions. I guessed the size of the smaller wins, but they’re a small percentage of the total and unlikely to dramatically change the outcome. The takeaway is that consensus expectations for $124.8m sales in 2021 incorporate the lowest possible values for secured wins and minimal end market recovery.

Proganics

This assertion depends on my estimate for the Proganics win being in the ballpark. Proganics is a newly launched service by Quest targeting grocery chains; it provides a single collection process for multiple waste stream, including floral, cardboard, unpackaged food, as well as packaged food, along with the packaging. The service cost effectively diverts 100% of organic material from the landfill to be feedstock for compost, biofuel or animal feed.

Large grocery store retailers spend between 65 and 125 bps of revenue on waste management; Kroger spends north of 1%. Quest estimates it diverts 60-70% of all grocery store waste versus 20-30% with current methods and customers can save up to 60% on solid waste spend for organics. Using these data points I ballparked the potential revenue for the 100 store win:

The potential caveats here are that this win cannibalizes some existing revenue (if these stores are current Quest customers) or Kroger, which helped Quest refine the Proganics process, gets promotional pricing2

Beyond 2021

Given that RFPs can take up to a year and new contracts can take 1-2 quarters to be fully revenue generating, Quest’s 2021 new business revenue will still reflect an impact from customers pausing/slowing their RFPs in the first through third quarter of 2020. Looking back at the list of mentioned wins, there’s a clear sequential acceleration in volume (even if you ignore the Proganics win). This will contribute to revenue growth above management’s 10-15% target in FY21 and FY22 as win rate normalizes.

Due to the turnaround that preceded 2020, Quest doesn’t have a baseline for the volume of wins to refer to for forecasting. However, a 10-15% growth rate beyond FY22 is very doable. It’s a highly scalable, small company with a compelling value proposition selling to massive businesses; they only need a handful of wins each year to achieve double-digit growth. They’ve already done the tough part of penetrating their target verticals and refined their pitch just when corporations are becoming more serious about sustainable waste management. Commentary from management is encouraging. From Q3 2020 earnings call:

“So first of all, I would say it's nice to see conversations starting back up that have been quite stale for a number of months. I think that's the first indicator on the pipeline. Beyond that, it's really, really all over the place again. Restaurant is part of it. We have a lot of automotive opportunities. There's a lot of people wanting to be engaged more in understanding the tracking and the ability to move programs like food waste in the stores, so they didn't have them before, food waste type of diversion programs. So I guess it's pretty broad on the pipeline opportunities as well. I think the best thing to say about it is it's moving. And the reason it's moving is because people are more open to having conversations and are being active about finding ways to consider new programs like ours.”

From the Q4 2020 call:

“The pipeline is moving much better from left to right. And I think the best way to look at the pipeline, instead of just the pure size of it is the movement of it. And we're able to push them across the goal line. And honestly, since COVID started, we're seeing things moving across the goal line now.

And I anticipate -- personally, I anticipate that accelerating as we more normalize our communications and our decision-making process at the prospect level. There's a lot more interest and I think the word we used is since the challenge is starting to dissipate for all of these customers, we're having more and more conversations than we are. So our pipeline has got a number of 7-figure type opportunities in it that we feel have got possibilities.”

And lastly, from the Q1 2021 call:

“We continue to have success adding new customers and are expanding business with existing customers. In addition, we've seen increased movement in opportunities through our pipeline and the pace of organic growth is picking up.”

End Market Recovery

Several of Quest’s major end markets, namely autos, restaurants and industrials, were impacted by COVID; their normalization will boost revenue growth this year and next. Industrials bounced back in Q1 as the industrial customer that declined in 2019 made a substantial contribution to Q1 2021 revenue growth. Miles driven, a proxy for the autos end market, improved sequentially and grew relative to 2019 in the first week of April.

Restaurant sales also improved sequentially but remain depressed versus 2019.

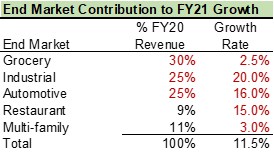

Management doesn’t break out its revenue exposure by end market, but you can make a reasonable guess from bits of information disclosed in earnings calls: all verticals are greater than 10% of revenue, Green Remedies is substantially all of the multi-family vertical and the restaurant vertical is the smallest end market.

This is by no means accurate, but this exercise is at least more grounding than picking an end market growth rate out of a hat. I made loose assumptions for end market growth rates based on management commentary and looking at trends in recovering end markets. I consider this exercise is too imprecise to guess at the composition on a quarterly basis (and it certainly does vary in 2020) and used this same composition for each quarter. My quarterly estimates will be off (underestimating the recovery in Q2 and overestimating in Q4 – it’s worth keeping in mind when Quest reports in Q2 results), but my annual estimate should be reasonable. Layering the end market recovery forecast into my bear and base cases yields my revenue projection for FY21:

Beyond FY21, FY22 will have a smaller benefit from lapping weakness in Q1 FY21. I still project 1% end market growth in FY22 and beyond because 1) I don’t have special insight here and prefer to air on the conservative side and 2) Quest’s customers are engaging with them because they want to reduce and divert waste – if waste volume is a significant contributor to growth, then Quest isn’t doing its job.

SG&A leverage will drive +600 bps of margin expansion by 2022

When Quest wound down its unprofitable contracts in 2016-2019, SG&A went from -9.9% of sales to -17% of sales as revenues shrank ~45%. As revenue growth inflects positively in FY21, operating expenses will re-leverage. In Q4 2019, CFO Laurie Latham asserted that “going forward, we expect operating expenses to grow at about half the rate of our gross profit dollar growth rate.” She later softened her language when pressed on the Q1 2021 call:

Greg Kitt

And the second thing that popped out at me were the incremental margins and I heard -- I think if I heard you correctly, we should expect OpEx dollars to grow at half of the rate of gross profit dollars. Did I hear that correctly? So if you grew 1 -- gross profit dollars by $1 million, should we expect OpEx to grow $500,000?

Laurie L. Latham Quest Resource Holding Corporation – CFO, Senior VP & Secretary

Yes. That's directionally correct. That's right.

There are a multitude of reasons to expect that this guidance will prove to be a lower bound for SG&A leverage, not a midpoint.

Reaccelerating revenue growth from COVID in FY21 and FY22 distorts the picture. That guidance in 2019 was meant for a normalized environment. If you forecast SG&A growth at half of gross profit dollar growth in FY21, you’re implying a severe deleveraging from Q1 when SG&A was 12.1% of sales. A better guide would be to look at the absolute level of sales Quest will generate and compare SG&A leverage to a prior year with a similar level of sales (say, 2017).

Quest is running its operations more efficiently than in the past, suggesting leverage could be greater than history shows. Projecting SG&A growth at half the rate of gross profit dollar growth in FY23 (the first normalized year) and beyond yields worse SG&A leverage than Quest showed in 2016 at a similar level of revenue. However, there’s a case to be made that new wins probably have a higher acquisition cost than expanding business with existing customers – and I’m anticipating new wins will be a meaningful driver of revenue growth.

Quest acquired Green Remedies, a significantly more profitable business that should bias margins higher versus historical performance. Green Remedies is ~10% of historical pro-forma sales and earned a 27% gross margin/19.8% operating margin in the 9 months preceding its acquisition. It would have added 60 bps to Quest’s FY19 operating margin, inclusive of acquisition related amortization. While the recovery of Quest’s other verticals will dilute Green Remedies’ contribution to margin in the near-term, the potential to grow the business from a regional waste service provider to a national one increases the odds that margin expansion comes in above guidance.

Keeping these points in mind, I forecast 680 bps of margin expansion from FY20 by FY22 and 770 bps by FY23.

Valuation & Conclusion

Here are the results of my model:

So, what’s it all worth?

Since I began tweeting and writing about Quest, the stock has closed some of the valuation gap with its peers but its growth opportunity remains heavily discounted. It’s difficult to look at peers or historical charts to get a sense of what’s the “right” valuation for Quest. There isn’t a public company with Quest’s asset-light waste service model and I don’t anticipate that a $113m company will get the same valuation as a liquid large cap. Quest in the future is not the Quest of the past, so it’s not appropriate to value it as if it were.

As an investor, my tendency is to be overly conservative than aggressive – I prefer to be positively surprised than negatively, to under-promise and over-deliver. It makes me more prone to making errors of omission than commission. Keep that in mind when considering my assessment.

I don’t have a single strict rule for valuing my investments, nor do I often have an exact sell target for quality companies delivering above-market returns. I usually triangulate where I think the stock may trade in the near-term and have a longer-term intrinsic value through a DCF that is closer to where I would consider selling.

Base case: 25x P/E on FY22 seems very fair to me. It represents a 4% yield that is growing at a ~27% CAGR in the mid-term in a 1.5% risk-free rate environment.

Bull case: Quest currently trades at 31x FY22 consensus, which is in line with the lowest margin peers (ECOL and CLH) and a 24% discount to the highest growth peer. With only two analysts covering the stock and limited liquidity, I’m not sure how reliable this is as a guide but it’s not an unreasonable multiple. A 31x multiple on my estimated EPS yields a $16 share price.

A DCF gives me an estimated intrinsic value of $18 per share.

What a multiple valuation doesn’t take into account is the value of excess cash (if you haven’t modeled it being redeployed). Quest is highly cash generative now and will have net cash by the end of the year. Management is clear that M&A will be an important part of their growth strategy but I haven’t modeled any future acquisitions. If Quest were to borrow 3x FY22 EBITDA and make an acquisition at 12x EBITDA3, it has the potential to another $1.23 in value to the stock.

In Conclusion

You’ve just read a lengthy write-up to argue that QRHC is worth a lot more than it currently is today, anywhere between $13 to $18 dollars. I hope this was informative and welcome any questions. I encourage you to research the parts of analysis this write-up hasn’t covered, particularly corporate governance (the chairman & top shareholder yields substantial control over QRHC) as you consider Quest.

Thank you for reading Part 2 on QRHC. If you haven’t yet, I encourage you to check out Part 1. Any questions or comments are welcome; subs and shares are greatly appreciated. You can follow me @AmbroseKira on Twitter for more.

The transcription service is quite poor and I made some edits for clarity. The original transcript is available here

If I exclude Proganics revenue from my forecast, my FY21 target takes a ~$0.35 hit, so I see this assumption as largely a risk to my near-term returns

For reference, Green Remedies was purchased at 12.4x 2019 EBITDA and 8x 2020 EBITDA

This is a great piece of research. Thank you for sharing, Kira.